Blog

Too Many CRNAs are Unnecessarily Broke

CRNAs and high-income earners are not immune to financial troubles. Financial success doesn’t happen by accident. Financial literacy forms the foundation of any financial plan.

Financial Literacy: A Checklist for Success

Financial success does not materialize without financial literacy. This blog entry boils down financial literacy to just a few points that fit on a sticky note. And I included resources for more detailed information.

What does a CRNA actually do?

If you ever wondered what a CRNA does during the workday, I have the answers. Read to learn about a standard workday in the life of a CRNA written by an independently practicing CRNA.

Account Comparison: Money Market vs High-Yield Savings

A quick rundown of different piggy banks. Read to find out the pros and cons of money market accounts and high-yield savings accounts. Which is best for you?

How Finances Influenced My Job Selection

Deny as you will, but compensation is a major factor in every profession and every job. Here is how I integrated compensation into my job selection criteria.

What is a CRNA?

What is a Certified Registered Nurse Anesthesiologist? Great question. Read on to discover what it means to be a CRNA.

Which is best? VTSAX, VT, VTI, or VOO?

A blend of insight mixed with solicited investing advice. All to provide clarity on investing avenues.

Removing Emotions from Investment Decision-Making

Retail therapy…Impulse spending…Panic selling…All influenced by emotions. None of these favor financial progress or long term solutions. Read about noting the areas emotion attempts to creep into our investment strategies and how to manage it.

Personal Residence as an Investment

A look at the avenues in which a personal residence acts as an investment. There is a key factor that makes these investment points strong.

Intentional Spending

I’m not opposed to spending money, but when I spend, I do so intentionally. I make it worth it. I drink the juice worth the squeeze.

The Moneymoon Phase

Nothing says trying to legitimize a blog like creating your own jargon. The moneymoon phase is the time to get ahead. It doesn’t last forever, so make the most of it.

5 Easy Ways to Save Money

5 ideas to decrease monthly expenses while attaining the lifestyle you desire.

529 Plan Explained

Everything you need to know about a 529 plan for education expenses. Another valuable tax deferred account to selflessly strengthen your financial family tree.

My Experiences with Financial Advisors

It’s important to build the right team to enhance personal and professional development. Each member comes at a cost. Look for value. The reason behind why I manage money the way I do.

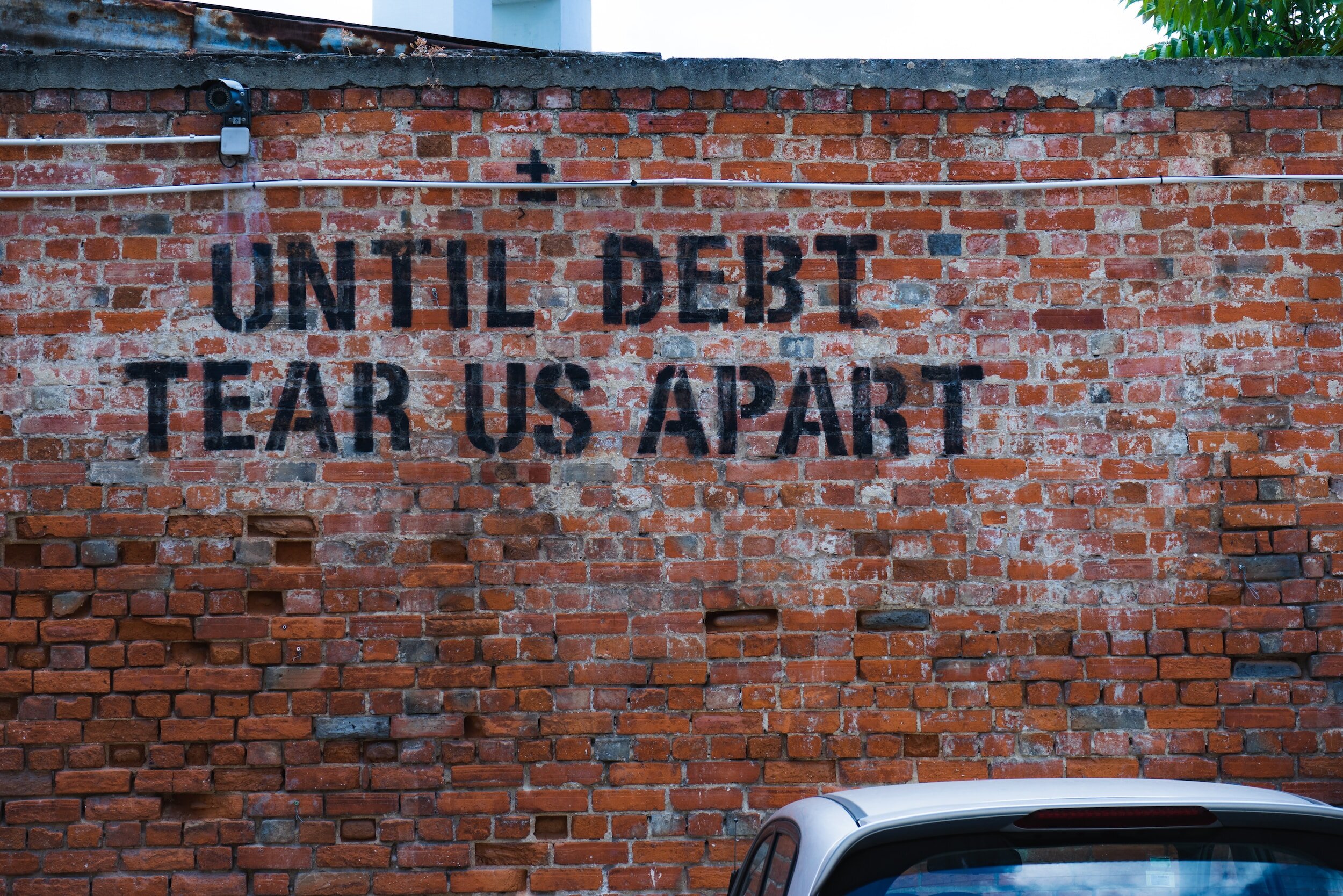

Debt: Pay if off or Let it Ride?

Debt is one of the talking points that will provide vastly different answers depending on your company. It comes down to math vs mindset. And what one stands to gain.

The Road Less Traveled

I challenge each of you to question the social norm of personal finance. If these ways pass inspection, proceed, but if a superior road untraveled presents itself, consider the road less traveled.