To Rent or to Buy: That is the Question

This is an age-old discussion. There are pros and cons to each. The answer likely differs based on financial situation, geographical location, and housing needs. Let’s look at a few considerations.

House buying has some advantages. The big ones include building equity through principle pay down and 3-4% annual appreciation. The addition of sweat equity is possible with a fixer upper. Ownership allows for renovations and customizations. Ownership provides perceived stability in housing costs and location. Additionally, having a substantial mortgage is an approach to putting away money in the form of equity.

Owning is not without drawbacks — such as the upfront costs. The traditional down payment is 20%, but more lenders are allowing much less at 3.5% or 5% depending on the loan type. Because mortgages are amortized, most of the payment goes to interest until year 20, which is typically the 50/50 point (half to interest, half to principle). Expect to spend 3-6% of the home’s value in closing costs to the bank and realtor both when you buy and sell. Renovations and repairs come next. Remodeling magazine says you can expect to recoup 60% of what you spend on remodels and renovations, so a new look may do good things for the space, but bad things for the wallet. Maintenance should also be considered at 1% of the property’s value annually. Less for a new house and more for an old one. Renovations, repairs, and maintenance all take time and/or money. Homeowners are responsible for all utilities including electric, gas, water, sewer, trash, internet, cable, etc. Depending on where you live, HOA fees may be a monthly $300 reality.

Renting has its place. Renting is easy to move in and out of because the application process is straight forward This is ideal when taking a job where you question the longevity. The upfront costs are low. I historically paid deposits equal to one month’s rent plus the first month’s rent to move in. Some places require last month’s rent up front as well. Apartments typically have low utility costs because the water meter is not divided, and trash is included. The square footage of an apartment is often less of that than a home, so the electric and gas are often times also more affordable. Sometimes management covers all utilities, but when renting a house, expect be responsible for all utilities. The costs for renovations, repairs, and maintenance are nonexistent. Play your cards right and invest the difference. It definitely sounds good on paper, but the execution is not always there.

The biggest opposition to renting is the entirety of the costs are sunken meaning you will not see any of them. There is no equity nor appreciation. Rents rise over time, but a mortgage remains status (unless you refinance or move). We all know privacy in the apartment setting is questionable. The maintenance, although governed by a strict set of rules, may be questionable. There is customization, but nothing major. A rental just doesn’t feel as cozy as a house with a green yard and a picket fence out front.

Enough small talk. Let’s see what I did. I have been an apartment dweller for the entirely of my adult life until recently when we took ownership of a small horse that they told us was actually a large dog. After a 6-month search for apartments, I concluded that the vacancy rate was 1-2%, they could be picky, and didn’t want people with pets. So we did the only logical thing we could: we bought a house.

Here is the overview of the house. We were thinking 2-3 bed, 1 bath. This place simply met the most criteria and was not as overpriced as others in the market. This place is nothing special and blends in well in this middle-class neighborhood. The fixtures, flooring, countertops, doors, etc. are all low end and borderline rental grade. This home has had regular turnover and shows the remnants of style changes through the years. My favorite was the bubblegum pink and pine green room with vertical rose gold sparkling wall tape. Anyway, this is what the monthly damage looks like for two people (and a large dog) with 800+ credit scores on a conventional loan

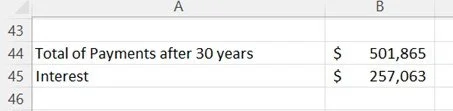

If we carry the loan out over 30 years without paying extra or refinancing, this is where we sit.

The original asking price was $250,000. We ended up at $275,000 due to an escalation clause, but negotiated the price because the roof needed replacing. Sellers covered the commissions. The house magically appraised for $255,000, the agreed upon price after negotiations.

This is a painful section. Most of these are just fees.

Here is the roof replacement. We had a quote in hand that we presented to the sellers. Two quotes were close to $14,000 and this one was just over $11,000. Renovations were limited to aesthetic changes. I patched approximately 150 holes in the drywall with 50 of them being anchors and 4 needing metal patches. Everything was painted. The kitchen received a face lift. Flooring was removed and changed in a couple bedrooms. New fixtures, hardware, and outlets throughout. Lots of TLC inside and outside.

This breaks down the magical equity everyone brags about and the sunken costs such as interest. I figured in appreciation and maintainance here as well. Based on this house being 40+ years old that passed inspection, I figured the 1% would get us close. Most of the equity after one year came from the down payment and appreciation. With the inflated prices at time of purchase, the home’s value could easily turn south and put us in the red. The sellers purchased this place in 2018 for $170,000-ish and didn’t put much money back into the place. They made a quick buck, but now need to find somewhere to live in the COVID market. Take careful note of the total loss each month based on the total cash invested - $2,038. This is the break-even point for rent. Over time, sunken cash decreases assuming there are no other major expenses that go above the budgeted capital expenditures of 1%. We are still at $1,624 for a break even point.

So the big question is…What can I rent for in this area – provided a dog wasn’t in the picture or I found a renter allowing pets? I found lower end 2 bed, 1 bath 800sq.ft. apartments going for $800 per month. Respectable 2 bed, 2 bath 1200-1500 sq.ft. houses are going for $900-$1200 per month.

These numbers do not come close to the break even points discussed above and yes, I knew this before we purchased in this area. I estimated a total monthly cost of $3,500-$4,000 depending on what we —we meaning my wife— wanted to renovate. Not a terrible guess.

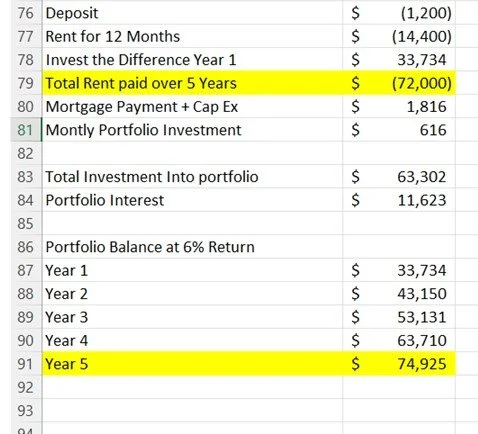

Let’s give the maximum benefit to the purchasing option and say I rent a $1,200 per month house and invest the difference at a conservative 6% return. The rent here is flat for 5 years because I am not proficient in Excel formulas or any aspect of Excel for that matter. The first year cost of home ownership, less rent for the house, went into investments the first year ($33,734). I would contribute the difference of my mortgage payment (plus cap ex) and rent payment to the portfolio each month ($616).

Over 5 years, I would sink $72,000 to rent and have a portfolio of $74,925. When buying a house, I will sink $97,464 and have (hopefully) $68,670 in equity. On paper, this is a terrible investment. In practice, happy wife, happy life.