Pitfalls of Wealth Accumulation

Earning more money doesn’t cause current problems to vanish. A strong income provided by a healthcare profession is a byproduct of performing necessary and valuable services. This includes all forms of providers and accessory staff alike. One would cautiously assume those making more money than the average bear, would be on the fast track to retirement and the good life. Reality says otherwise.

Webster defines “pitfall” as a danger or difficulty. The nuance of the word includes covered, camouflaged, or unseen dangers. And this nuance is where high income earners struggle to build wealth. I’ve said it many times -- wealth building is simple on paper, yet extremely difficult to execute.

Fun Statistics

Fortune.com writes about a survey stating 57% of folks can’t cover an unexpected $1,000 expense. Ok, $1,000 is a fair bit for most people. How about a smaller emergency expense? Bloomberg.com and Federalreserve.gov agree that two-thirds of folks can’t cover a $400 expense. But that doesn’t apply to high income earners. Right?

WRONG!

Bloomberg.com has another article stating one in three Americans earning at least $250,000 annually live paycheck to paycheck. Miss payday, miss the mortgage payment. Lose employment, lose lights and water. Injury leading to disability is really leading to the family not being able to eat.

Prepare yourself for two concurrent references…

Everyone is delt a hand in life. Every hand holds a spaghetti Western mix of cards like the third film of the Dollars Trilogy – The Good, the Bad and the Ugly. Not if your hand has some sour grapes, but how many. And if you found your way to this blog, chances are you have a whole lot more Clint Eastwoods than Eli Wallachs. Stretching for references, I know.

You likely make a respectable income closer to $250,000, than the $50,000 mark. You had/have your share of aces. I know I did. It’s a shame that one in three of our high-income peers struggle financially.

I’ll go back to my day job, but first… how to dig out of a financial hole? Or better yet, visualize the pitfalls that lay before us.

It’s no secret I lack all forms of creativity, which only adds “self-humor” to my weekly posts (because that’s a word). No creativity means my blog posts come from experience -- more recollection than synthetization. I have personally experienced or witnessed the following pitfalls.

I’ve Earned It Mentality

Classic. Extremely common in high opportunity cost professions.

“I finished decades of training to become the skillful and knowledgeable provider I am, so I deserve to treat myself. I delayed gratification for soooo many years due to time commitments or monetary constraints. I now deserve to spend my hard-earned income on a life of luxury.” Yep, if we haven’t been there, we have for sure thought about it.

“The bank knows about my $250,000 in student loans, vehicle payments, and credit card debt, BUT when I showed them my spectacular job contract, they agreed to finance my $600,000 house. They also agreed to finance a couple new SUVs while I’m impulsively spending my income. Need to get me hooked on the payments before I realize I’m living paycheck to paycheck and become a Bloomberg statistic.”

Move for a job and buy a house. Woah, slow down! You might not like the job or area and now you tied up a bunch of money in a house. Youngers, consider slow playing the purchases for a bit. Delay gratification until your portfolio says otherwise. Please, treat yourself. But try to restrain from making six-figure purchases until the debt situation is under control.

Really though. So so so many SRNAs, residents, pharmacists, and even nurses come out of training, flash their contract, and get approved for almost any financing. They approved my wife and I for something like a $1.8M house in a rural town. Fresh out of school. There are probably only 10 houses in the town over $600K. And they are excessive for what we “need.”

Live like an SRNA, resident, or student for a bit longer. You earned the title, income, respect, prestige, and your place on the socioeconomic ladder. And with time and planning, you will earn all of the luxuries your heart desires.

Cliché incoming: A car you can write a check for is a blessing. Another $800 monthly payment for the same car is a curse. The right move at the wrong time is the wrong move.

Hedonic Adaptations

My 15-year-old self wanted to be a CRNA. I put in the work and became a CRNA. I enjoy the practice and the lifestyle it affords. This “CRNA lifestyle” is my new normal. My new baseline. It is difficult to downsize or regress in any way.

Think about your current dwelling. Ok, now you are moving into an apartment with your 8 closest friends living on the same floor. Rewind farther to a dorm room. Great times, but I don’t care to share a 10’ x 12’ room any longer.

The hedonic treadmill made the transition from a dorm to a 650 sq. ft. 2-bedroom apartment quite enticing. I adapted to that life and moved to an up/down duplex of 550 sq. ft. Smaller, but significantly more private. A few more apartments to during school, but my wife and I have been living in a house for the past 9 months. Feeling pretty spoiled.

From here, I will quickly adapt to the low-end furnishings and will theoretically look for an upgrade when we move. So on, so forth. You get the idea.

Take home -- be careful how quickly you elevate your lifestyle because hedonic adaptations exist. Handle your business first.

Lack of Direction

There is a great deal of literature out there providing guidance for almost anything and everything. Books, podcasts, seminars, and reluctantly, social media. A staggering amount of young folks absorb reckless information from social media influencers.

Think back to your thesis project or other evidence-based projects. Find an information source. Understand the objectives of their research. Do their objectives align with yours? Consider the data supporting their recommendations. Anecdotal? Meh. Statistically significant – now we’re talking.

Example

I’m a big financial independence (FI) guy. Do you want financial independence, F you money, and the ability to walk away from earned income? If yes, continue. If not, then The Financial Cocktail is not for you. Seriously.

My views on personal finance are much like anesthesia. The preop assessment is where I gather puzzle pieces. Lots of considerations. There are so many theories about handling personal financial matters, so look at the research. Save some time and read reputable sources.

The anesthetic itself comes down to odds and probabilities, much like selecting investments. Old and unstable – choose that induction cocktail carefully. Young and healthy – way more latitude with induction agents and investment opportunities.

If my financial situation is “unstable” with high interest debt, I need to be rational, systematic, and precise. With interest rates on the up and up, high interest debt will be commonplace. If you kicked those Grad PLUS loans out the back door, you have room to withstand volatility, which may provide substantial returns.

Eliminating high interest debt and starting to invest means your situation is like a healthy 25-year-old for a lap chole. A fresh SRNA could induce this patient with any reasonable dose of any reasonable agent(s) and they would do fine. Not recommending, but just saying, there is latitude. At this point, it’s fine if your portfolio only returns 6% instead of the 8% you were hoping for.

Once you have direction – Pay this down, invest in this, live off $xyz per year, you have arrived at the maintenance phase of anesthesia. Keep an eye on the monitors and relax. That eye on the monitors is your monthly or quarterly financial review. We update our net worth tracker every month too. Keep those financial vitals where they need to be.

Without direction, folks never reach the relaxing part of maintenance phase. It’s like giving a bunch of pressors for a soft blood pressure. Now hypertensive crisis and an orthopedic surgeon asking “what’s the blood pressure?!” Push a bunch of propofol, gas way up, betablockers, clevidipine. Orthopod is happy, but BP is 60/40…here we go again with the phenylephrine. Have a plan, set a course, make it happen.

Lack of Boundaries

I have witnessed terrible interpersonal conflict. You make good money, and everyone knows it. We hear about the lottery winners who go broke because they buy mom and dad a new house. Buy all the siblings new BMWs.

Even the aunts and uncles get a vacation out of the deal. Not to mention old friends and people claiming to be a third cousin twice removed. Lottery winners end up squandering $150,000,000 in just a few years.

Well, you don’t make that much, so it’s even easier to give a few hundred thousand away to friends and family and end up broke next to the last lottery winner. Hopefully your support system respects your financial plan and shares in your victories.

While you are paying off those loans, it’s okay to let family know you can’t make the annual trip to Mexico this year. You don’t have the disposable income to tag along. As soon as we reach a stable level, that maintenance phase… we would love to partake in whatever annual Christmas getaway has been established.

Even microlevel pressure is difficult. Go out to eat and they expect you to pick up the tab. You are the big dog at the table, so you should cover the evening. Maybe. Was this established? Do they assume your hard work covers their tab? Hitching a ride on your coattails?

Plenty of successful, high-income earners struggle setting boundaries with friends and family. Sometimes it’s not worth keeping the friends. It’s tough to separate from family, but if toxicity and irrationality is the alternative, something needs to be done. Set boundaries.

My wife and I have financial goals that required us to move 1,400 miles. We live a certain way and make the money that meets our investment goals. Some family understands that. Others, not so much. And that’s okay. I don’t try to explain it. We don’t talk about what I make. I wear the same cloths, drive the same truck, and act the same in the same tightwad ways as prior to my newfound CRNA income.

We lived in Dutch territory for a while and I half-jokingly say the stereotypical frugality rubbed off on me. And we can thank the Dutch for stroopwafels. Never heard of them? You’re welcome!

Anyone is welcome to fly down at any time, for any duration. We will gladly pick them up from the airport. Their stay at our house is of no cost. The food is on us. They can drive our vehicles. I think we even have extra toothbrushes. We have no problems coving those costs. But the job was necessary. We are just happy to see family. Those are the boundaries, and we all get along.

Underestimating Future Costs

The future is unknown, dark, and scary. All the more reason to prepare with a map, multiple flashlights, snacks, plenty of water, and the comforting stuffed animal of your choosing.

Recent inflation has been abnormally high, over 9%. But for years, inflation has been quite manageable. Inflation is a major hinderance for buying power.

Let’s take inflation at 3%. Which is on the low end. And you live off $100,000 for easy math. Here is what that cost of living looks like 10, 20, and 30 years from now.

2032 Equivalent = $134,000

2042 Equivalent = $180,000

2052 Equivalent = $242,000

The days of being debt-free and retiring with $1,000,000 are ending shortly. Those hedonic adaptations kick in and your cost of living may continue to rise aside from inflation. I have some blog posts here about calculating retirement. It’s nice to know your FI number, which is essentially how much you need to retire. That accounts for inflation and the change in buying power.

It's better to have extra stashed than fall short in your late 60s. Awkward.

Paying Fees

I’m not talking taxes, but there are plenty of those. John Bogle’s The Little Book of Common Sense Investing was the first time the magnitude of fees became apparent. The book essentially recommends low-cost mutual funds with an expense ratio less than 0.2 or 0.2% because fees trash your gains.

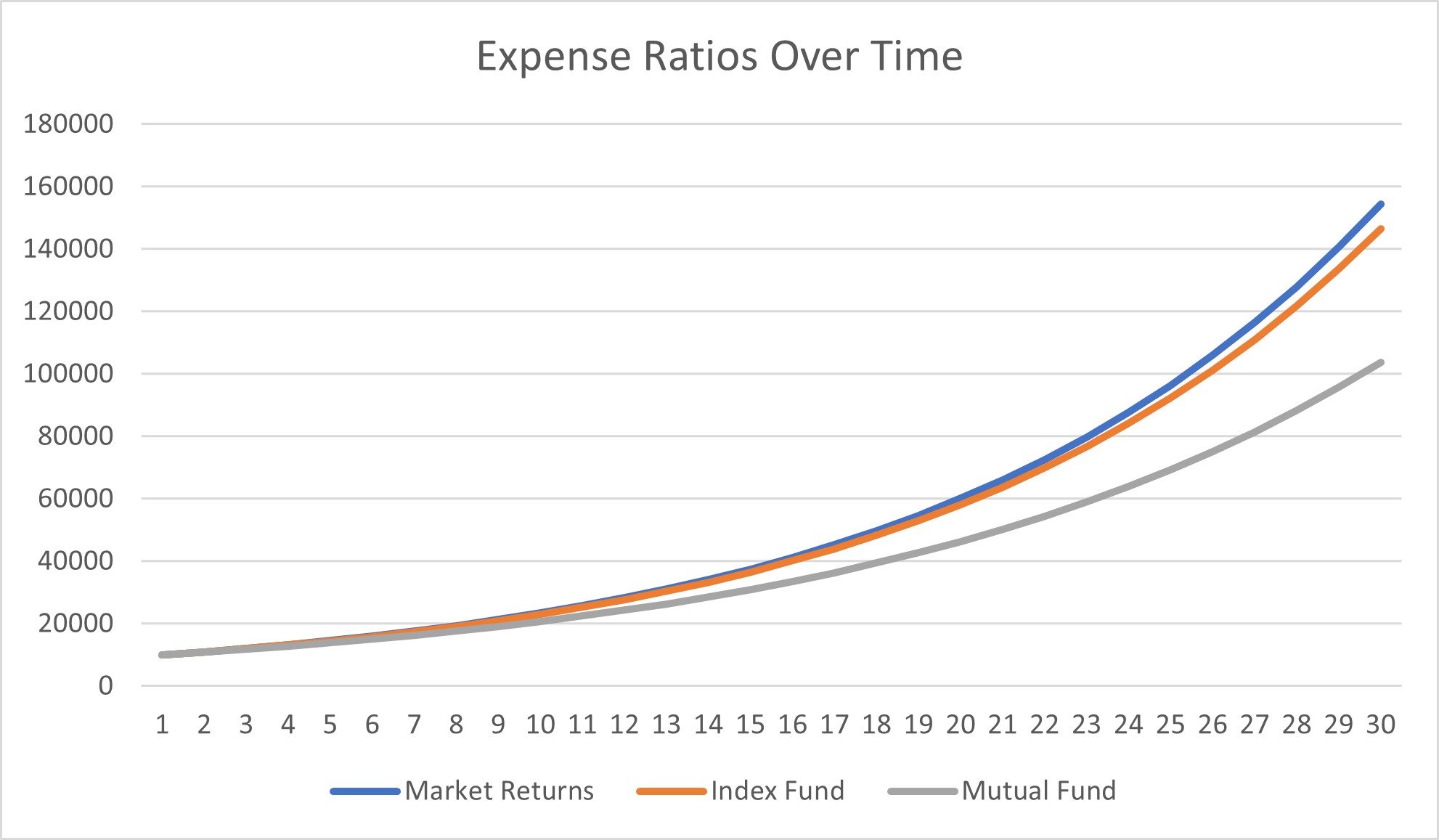

They run the numbers of common expense ratios over the course of a lifetime and it’s staggering. You have an account with $10,000 invested in the S&P 500. The blue line is the average market return over 30 years. The orange line is an S&P 500 index fund with an expense ratio of 0.2%. The grey line is an S&P 500 mutual fund with an expense ratio of 1.5%.

Here you go Dave Ramsey fans. Solid program for eliminating debt, but his investing rationale leaves something to be desired. And that’s gains.

The market total ended up at $154,000. The index fund finished with $146,000. The mutual fund finished dead last with just over $103,000. The power of fees in a world of compound interest.

Now that we established that fees are a ball buster, what should be look for? In the example above, certain brokerages such as Vanguard, offer index funds with expense ratios of 0.03-0.07! That would put to total even closer to market returns.

Sponsored? LOL…No.

Biased? Yes.

Do I care about this bias? No.

If you invest in those low-cost funds through a brokerage like Edward Jones, you are on the hook for the fund fees, PLUS the brokerage fees from Edward Jones. I have used two different paid brokerages and they averaged about 180 basis points, which is 1.8% off the top win or lose. Not only did I underperform the market, but I paid 1.8% to do so. Hence why I self-manage.

Even 401(k) plans typically have a higher expense ratio than what I pay through Vanguard. I transferred an old employer plan and picked up those fees. It was worth the time and small transfer fee.

Hedge funds commonly have a 2% fee, plus they take a 20% “performance fee” on profits over a certain threshold.

Whole life insurance. Huge fees. Last I heard, it was about three years of payments to break even with all of the fees. Remember my very fancy chart when you look at plans and fees.

Financial planners may be worth the fees if you have a large sum and need assistance establishing trusts and ensuring all entities are protected. It may be worth the peace of mind. If they want to invest your $10M and take 0.5% every year, I’d reconsider.

CPAs can be valuable. They charge fees, but they may pay for themselves. Maybe they save you time doing your W2 taxes. Fair. If you are 1099, I would definitely have one you trust. They maximize business expenses and assist with tax advantaged accounts. Even a small finding in the tax code will likely cover the cost of their services. Plus, their fee is a business expense.

Yet again I ramble on for over 2,300 words. Thank you to everyone, especially those who stuck it out this long. Best of luck!