5 Reasons NOT to Follow TFC Advice

Friedrich Nietzsche doesn’t exactly fit the personal finance savant architype, but that doesn’t mean there isn’t something to take from his writing. I don’t recall the name of the piece, but I summarized an idea from one of his works for further consideration -- become an inquirer, not a follower.

We begin life as a follower throughout childhood and early adulthood. We are without original ideas and mimic those before us. Adulthood is where our upbringing and personal life experiences create a new way of thinking. Exclusively following becomes a way of the past.

Personal finance is no different. We learn from our parents. We learn from our peers. Don’t blindly follow but reflect and learn. If you learn to see for yourself, it creates a true reality. Individuals then come together and compare lessons. Everyone is better for it.

This blog is a place where individuals come to share their experiences and ideas. As the title says, please don’t blindly follow my way of handling finances. A recent social media comment summarized The Financial Cocktail to a few readers understandably questioning aspects of the post.

It perfectly summarized The Financial Cocktail and went something like this:

It’s just two people early in their careers working a lot of hours, making good money, and saving most of it to achieve financial independence in their mid-30s like a couple of weirdos.

I absolutely love it. Thank you for understanding. This blog is not a step-by-step personal finance plan for every human, nor every CRNA. I discourage anyone from following to a T.

Rather, think of this blog like a book. If you spend a few evenings reading a 300-page book and find a pearl or two that will make a notable change in your life, that’s time well spent. And if you read multiple posts without anything to take home, thank you for giving it a go and my apologies for the wasted time.

I’m here offering my experiences and learnings hoping to help my fellow CRNAs and anyone else who may stumble upon my collection of ramblings. Sure, I use some degree of rationale, but it only needs to make sense to me because we are after all speaking about my blog about my personal finances.

On to the main event explaining 5 notable reasons you should NOT follow my advice.

Unique Goals and Values

As with most advice, look at who is giving the advice. What are they trying to achieve? What do they hope to achieve?

Think back to teachers who went out of their way to help you understand that mathematical concept that would certainly show up on the ACT/SATs. Maybe that basketball coach who shared shooting techniques that would not only bolster your stat line but propel the team to victory. Your goals aligned with their goals.

That memorable CRNA who was a great mentor during a clinical rotation. They went out of their way to ensure you were learning the necessary content to become the best CRNA possible. Effort that betters you as an individual and the profession alike. Win-win.

When readers reach out for financial coaching, it’s beneficial to start with goals and values. It’s counterproductive to force my personal goals and beliefs on individuals because not everyone’s ship is heading the same course.

That’s why we sit down together and determine a heading. I try on another pair of shoes and provide input as to how I would achieve the desired goal. It’s intended to be a brainstorming session to consider various approaches to accomplish a given objective. Just like anesthesia, there is more than one way to successfully accomplish the case.

And in a pinch, a fresh set of eyes on the problem makes all the difference.

Unless this is your first time reading a TFC blog, then you have an idea that I’m about financial independence. And not simply financial independence. Early financial independence. I want to earn and invest enough money to build a nest egg that will produce income for decades to come.

If you are also seeking financial independence or FIRE. Financial peace of mind. Financial stability. There are ideas on here for you.

Unique Priorities

Priorities are the speed and strength of interventions to accomplish the goal. Priorities change over a career and lifetime. The list of attributes is endless. Life is dynamic and priorities change.

I know of folks who want to retire in their 50s, but insist on an annual trip to Europe. Fantastic. Travel is a priority.

An affinity for shiny things creates a lifestyle desirable to many. Maintaining such a place on the socioeconomic hierarchy is something to consider.

The scale of time vs money. Apply this to every decision, financial or not -- each person will prioritize uniquely.

My prioritization of time vs money hit me hard after acquiring a CRNA income. I work a great deal, so time is short. When I have free time, money becomes less of a concern. Mind you, savings rate is still a top priority, but I have some discretionary spending to play with.

Mrs. TFC and I flew back to the Midwest for a baptism. We had a limited window away from work. And equally limited flight options to get us there. The price of the flights was irrelevant. It was purely about booking what would allow us to travel from point A to B in the shortest amount of time and maximize our time with family. That’s it.

And yes, they were significantly more expensive than if we would have had more flexibility to travel. Such a strange concept. Something I did not begin to grasp until recently.

Inversely, if one seeks early financial independence, price becomes more of a concern. The give and take.

I am currently operating on a short timeline for financial independence. This comes at a price too heavy for many. Simply deemed undesirable. And that’s okay. Abnormal effort and abnormal interventions for abnormal results.

Really though, I don’t recommend the timeline I have selected. If anything, pay off high interest debt quickly which will put you on the desirable side of compounding interest. Start intensely and transition to a sustainable investment strategy thereafter.

Unique Circumstances

Circumstances may be elective or non-elective. Children, marital status, wellbeing…the list goes on indefinitely. Each of these circumstances demand some amount of time and/or money. They significantly impact income and expenses.

Circumstances influence what type of job is best, how many hours per week, where to live, etc. To think circumstances do not influence one’s financial situation would simply be unreasonable.

We are all dealt a hand in life. Most contain at least a couple undesirable cards. Managing the hand makes all the difference.

The Poor

I didn’t grow up in extreme poverty, but the concept applies nevertheless --

If bill collectors confiscated every dollar at the end of the month, one would be rather inclined to spend that money because either way, there would be nothing left. If spent before that time, there would be food or something enjoyable. This creates a cyclical way of life.

SRNAs are not all that different from the poverty scenario above. Money is tight. For years, any earnings go towards tuition. This begins a cyclical way of life.

I don’t fault CRNAs for living paycheck to paycheck because spending everything was normal. An empty bank account is normal. Living off borrowed money is normal. Living without an emergency fund is normal. Not saving money is normal.

It takes a significant amount of discipline to transition…no, transform from a broke SRNA to a CRNA who lives below their means and invests towards retirement.

The Wealthy

I have heard many misunderstood concepts about generational wealth which works similarly. A family rich with resources, connections, and knowledge has access beyond what is comprehensible to most.

The United States tax code is available to everyone, but not everyone has the means to fully utilize the incentives. I appreciate philanthropy, but I didn’t realize what a strong tax advantage donating money could be. If you are trying to put food on the table, you aren’t concerned with the appreciation of the artwork you purchased with the intention to donate for a tax deduction.

Two pretty bad examples, but my best attempt at displaying two very different financial circumstances.

I read more than a couple comments about the perceived circumstances of my life and how it affords me the ability to accomplish certain milestones financially. I have done a pretty good job biting my tongue because my hand holds a couple of sour cards not known to many. Revealing these significant hindrances would only embarrass and humiliate the naysayers.

Again, I don’t recommend an impossibly short FI timeline. But it’s amazing what can be accomplished with a little willing hardship and a lack of excuses. I say this out of respect for those who handled their undesirable circumstances with grace.

Risk is Individualized

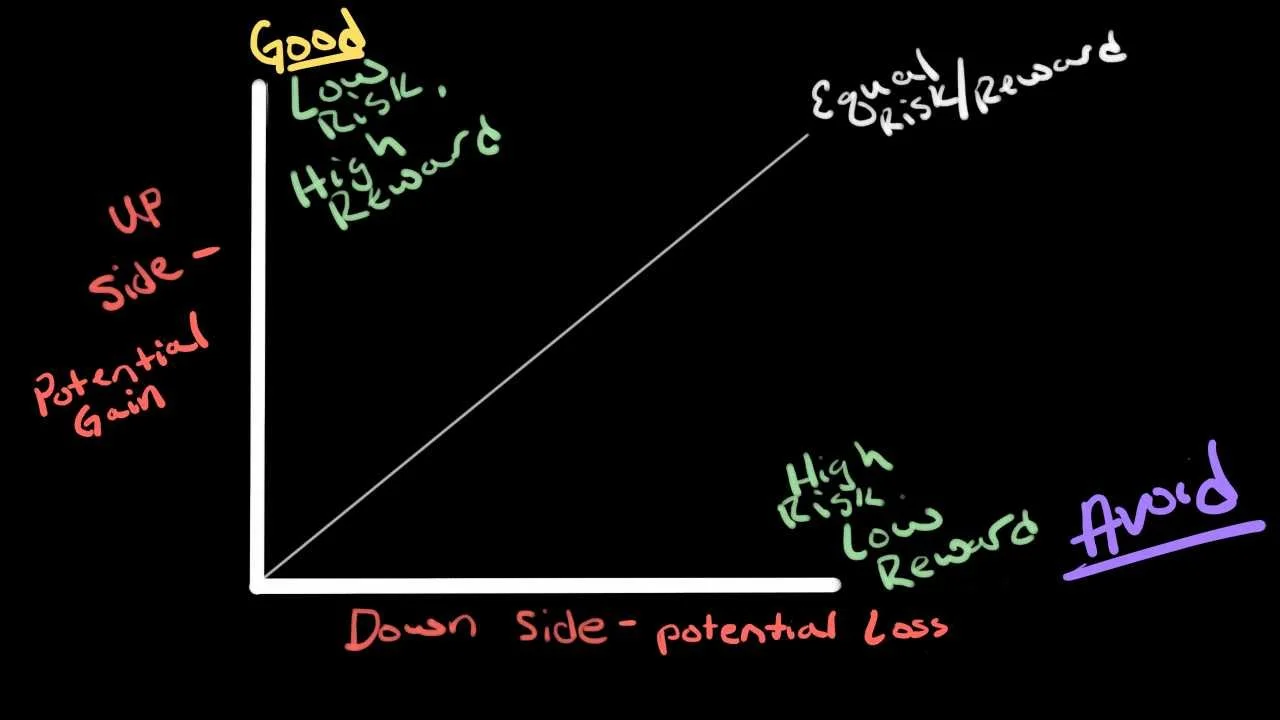

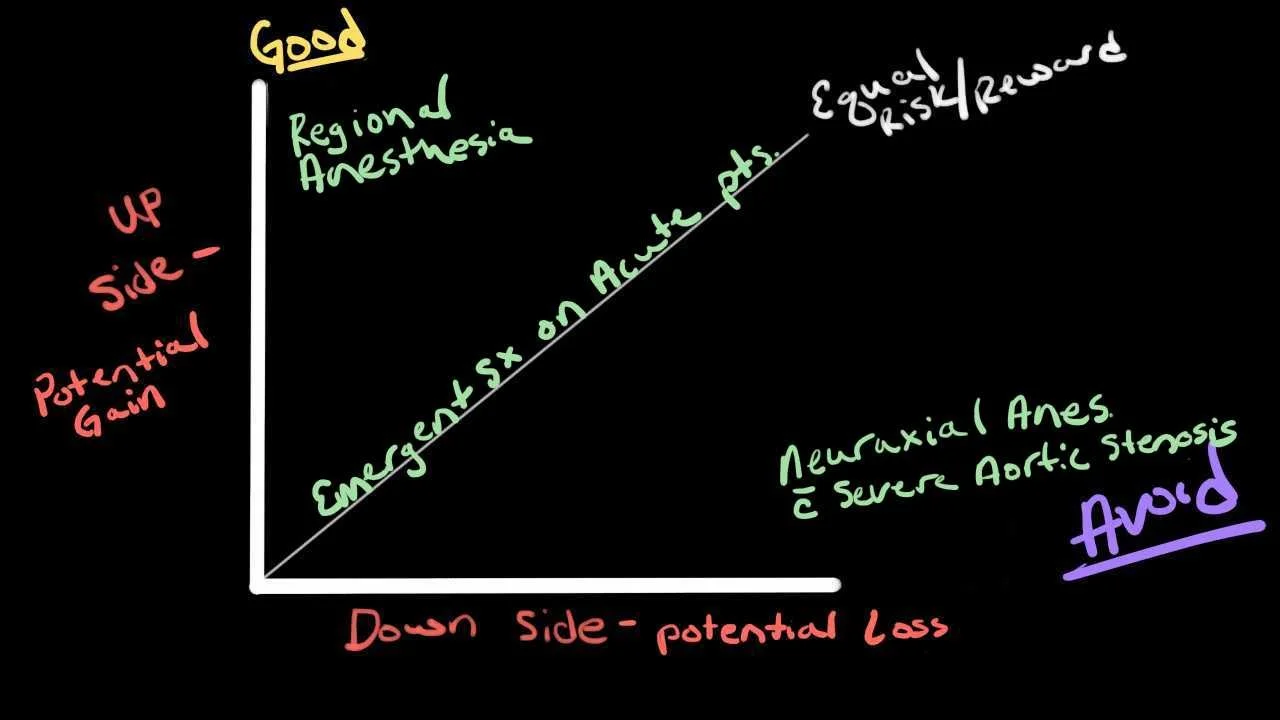

Risk: Challenge the Dogma does a…job of explaining my perception of risk. Because I have a post on risk, I won’t babble on too much longer. Just know, the post expounds on the following image created by yours truly:

And here is an anesthesia example:

Back to a financial example that doesn’t have a cool, custom illustration —

Invest a small amount of money in an unknown stock or cryptocurrency that goes to the moon. A simple $1,000 investment just made you a multimillionaire. If you can’t sleep at night knowing your portfolio may go to $0 when you wake up, then you are in the wrong investments.

Maybe it’s real estate or venture capital. All of the investments for high upside potential are often the same investments with major downside potential.

Emotions play a massive role in investments and money decisions in general. Some people try to get all mathematical on which debt to pay off based on the interest rate. Others have an aversion to all debt. The perception of risk varies person to person, so invest accordingly.

I have a list of investment options here if you are looking for some ideas. And yes, I know more than a couple old farmers who use the “wooden chest” option.

We can discuss theoretical outcomes of various investment strategies until the cows come home. At the end of the day, advisors use history mixed with current economic conditions to produce a guess of what might happen in the future.

No guarantees in life short of death, taxes, and the fact that a given plan won’t work as such. Life lesson there.

Anyway, my risk tolerance is just that…mine. I base my investment strategies on books found in the must-read list because that’s what makes sense to me. And it will change as my priorities and circumstances change.

Maybe you are close to retirement. Maybe you have a bunch of student loans you are trying to get rid of.

I attempt to account for the various types of readers in various financial places by providing the steps that I took and plan on taking. Again, The Financial Cocktail is about my personal finance journey and nothing more. If you can take something from it to apply to your journey, please do. I’m delighted you found a pearl making your time well spent.

Perspective

The eye of the beholder. Or in this case, author.

It’s just two people early in their career working a lot of hours, making good money, and saving most of it to achieve financial independence in their mid-30s like a couple of weirdos.

Still one of the funniest comments, so thank you again.

I don’t mind working as much as I do because I find purpose in giving anesthesia. I enjoy going to work. In my opinion, it was time well spent, even if life sees a premature ending.

I view the compensation for my labor as a tool. As a means to trade for goods, services, experiences, luxuries, and time. Most importantly, time. Remember how I spoke about working hard and having a high savings rate to accumulate a nest egg that would produce? Well, I believe that’s a good way to go.

J.L. Collins does a way better job of explaining the purpose of financial independence, which he calls “F YOU money,” in his book, The Simple Path to Wealth: Your Road Map to Financial Independence and a Rick, Free Life. Highly recommend.

It’s the ability to walk away from a job you don’t like. It’s the ability to do what you want without worrying about earned income. It’s about being generous with your time and skills. It’s about making life what you want.

The takeaway this time is my age. Old enough to have started a respectable career and a mid six-figure net worth. Young enough to be sick of being broke.

I haven’t lived through a bunch of major life events, so theory plays a major role in my decision making. My enthusiasm remains.

For your own sanity, do not mirror my personal finance lens as it will drive you, your spouse, and your kids up the wall. However, it will produce some great reading in the comments section.

And if readers align with your…unique…perspective on life, they will reach out with their kind words. Some will seek your input on their finances because they see value in some part of my methodology.

Professors of anesthesia programs will reach out asking you to share some of your perspective with SRNAs. And other CRNAs who go beyond giving anesthesia will reach out.

It has been a crazy, ego driven journey that will hopefully turn into a good story one day. As always, thanks for reading.